Insight:

Investment Compliance -

The Missing Link

Home / Insights / Compliance

Investment Compliance - The Missing Link

Role of Investment Compliance Functions

The Investment Compliance Function, also commonly referred to as Investment Guideline Monitoring, Portfolio compliance or Mandate Monitoring, is arguably one of the most important Risk Management functions for an Asset Management firm. Providing an Asset Management firm with the ability to monitor and control portfolio assets versus regulatory and legal restrictions on a real-time basis against trading activity.

Given the large size of assets under management (AUMs) of many global asset managers and the respective high monetary value of individual trades, the importance of investment compliance systems and functions in controlling breaches of regulations or legal agreements on a pre-trae basis a fundamentally important risk mitigation activity of an asset manager.

History and Development

Investment Compliance Monitoring systems were developed and adopted in their current form more than twenty years ago. They have of course been greatly enhanced and gained a significant number of functionality improvements to allow for complex rule monitoring since then.

When one evaluates the Investment Compliance function holistically however, it has perhaps not seen the level of significant development and improvement for which there is scope.

The compliance (and other) teams within Asset Management organisations have evolved to operate the systems in better ways, and the functionality of the systems have improved, however the type of breakthrough enhancements that one would expect such a function to see, have not yet occurred.

The Missing Link

Given the general advancements in technology, AI, document reading etc, the Investment Compliance function will undoubtedly have many further improvements in store for itself.

The hope is that the investment Compliance function will be eventually completely automated with minimum requirement for human intervention.

Further developments of the Investment Compliance function will likely depend on the two key inputs of the function that have remained stubbornly positioned relatively far apart from one another:

- Legal Documentation (Investment Management Agreements (IMAs)):

- Investment management agreements are typically written in an unstructured manner. Codable investment restrictions are included within the larger overall legal document, with the restrictions and related definitions are often to be found in different sections of the document.

- The language of the investment management agreements is commonly not “standardised”. In this context it means it is not written in a format that will call out the key components when considering an Investment Compliance rule in a particular logical order (for example: rule limit, denominator, numerator, issuer / country grouping etc.), but rather being written in legalistic freehand jargon.

- The link between the investment management agreement and the market security data, against which the rules are coded within a compliance system, is often missing. Typical examples of this are the use of the following words:

- ‘Country’ without the specification of country type, for example Risk Country, Country of Incorporation, Country of Issue.

- ‘Sector’ without specification of whether it refers to Bloomberg, Barclays, GICS sectors, also not specifying as to what level of sector schema it refers to.

- ‘Minimum Investment Grade’ without specification of credit rating methodology, rating agencies to be used, or whether the rule must look to the underlying rating of positions effected through credit derivatives.

- This is also often as basic as the asset types to be included within a particular rule not being defined but rather defined with broad stroke terminology such as ‘fixed income’, ‘credit’ or ‘liquid assets’. Compliance teams then typically work through these open definitions with portfolio management and other departments and code accordingly. When there is large scale lack of clarity in the definitions existing within the IMA documents the risk of errors increases.

- Investment Compliance Systems

- The modern Investment Compliance Systems provide users with a great level of functionality to accurately code and configure against the restrictions, even highly customised restrictions, the way they are set out IMA documents and regulations. The major systems, BlackRock Aladdin, Charles River, SimCorp, ThinkFolio and LatentZero Sentinel allow for accurate capture of asset types using Data Provider security level data, configuration / development of custom compliance exposure calculations and measuring of derivatives risk exposures within the various types of compliance rules.

- The systems are designed to operate in a way that gives the end compliance user almost ‘unlimited flexibility’ on how to configure and codify the compliance system:

- Typically, there is a completely blank canvas on how to formulate a compliance asset hierarchy, i.e. the attributes and groupings that define assets and asset classes, based on data provider data. Having these attributes set up accurately, and standardised across the board is crucial as they underpin all coded compliance rules.

- The systems will normally also allow for a completely flexible definition of monitoring methodologies, for example what issuer hierarchy level to use, how to define liquid assets, how to calculate and net derivatives exposures and so on and so forth.

- There are also no limitations on the formulation of the rule syntax logic, i.e. a similar or the same rule could be coded in many different ways whilst still producing the same outcome when run against portfolio positions.

- The level of flexibility provided by the compliance systems is a positive and necessary feature due to the complexity of the requirements within investment compliance monitoring. When combined however, with the ambiguous and unstructured nature of the IMA documents, the highly configurable and flexible and flexible nature of the compliance systems leads to a generic lack of standardisation for a function that could in its best form be ‘mechanic and standardised’ in nature.

Potential Future Developments

The Investment Compliance Function is simply the processing of deterministic restrictions and rules against a highly standard set of asset and calculation types. One could therefore expect the function to operate like a machine, in a mechanic, standardised way, with limited need for human intervention. Clearly the function depends on data from external system vendors however, the best methods to use the data to identify asset types and attributes are for the most part, known quantities.

Closing the ‘missing link’ between the restrictions laid out in IMA documents and compliance systems data model, coding language and functionality, is where work could be carried out to greatly enhance monitoring quality and standards, increase automation and therefore decrease and even mostly eliminate the need for human intervention.

Continued...

The most obvious place to start is to standardise the restrictions section of the Investment Management Agreement. Initially this could simply mean adding a standardised and detailed section of the restrictions at the back of the document, to complement the legal text. When this exercise is undertaken thoughtfully with underlying system data providers data attributes, as well as system functionality and standard compliance calculations in mind, it can bridge the gap between legal documents and the actual monitoring that occurs within the system.

The strongest argument often stated against trying to standardise the investment restriction section of the IMA document is: “…our institutional clients will never agree to that.” Counter argument to this could be that perhaps the institutional clients would at least agree to an additional summary section in the document to rationalise and specify the restrictions drafted by lawyers and consultants.

The Rationale and Benefits of Standardising Legal Agreements (IMAs)

Why and how standardising the restrictions of the IMA document could be so beneficial:

- Removing ambiguity between the legal wording and security data / attributes, asset class definitions and monitoring methodologies.

- Spelling the restrictions out precisely as to how they work in the system and how they are coded to operate.

- Creating a standardised rule library to which each new client’s restrictions can be directly mapped without additional rule coding and testing effort. Yes of course there will be some new complicated custom guidelines that occasionally have to be coded as new.

- Calling out the rationalised rule following the logic by which it can be coded to enable automated coding of rules based on the rule descriptions sometime in the future.

- Reducing the number of staff required to run the function.

The Path to full automation of the Investment Compliance Function

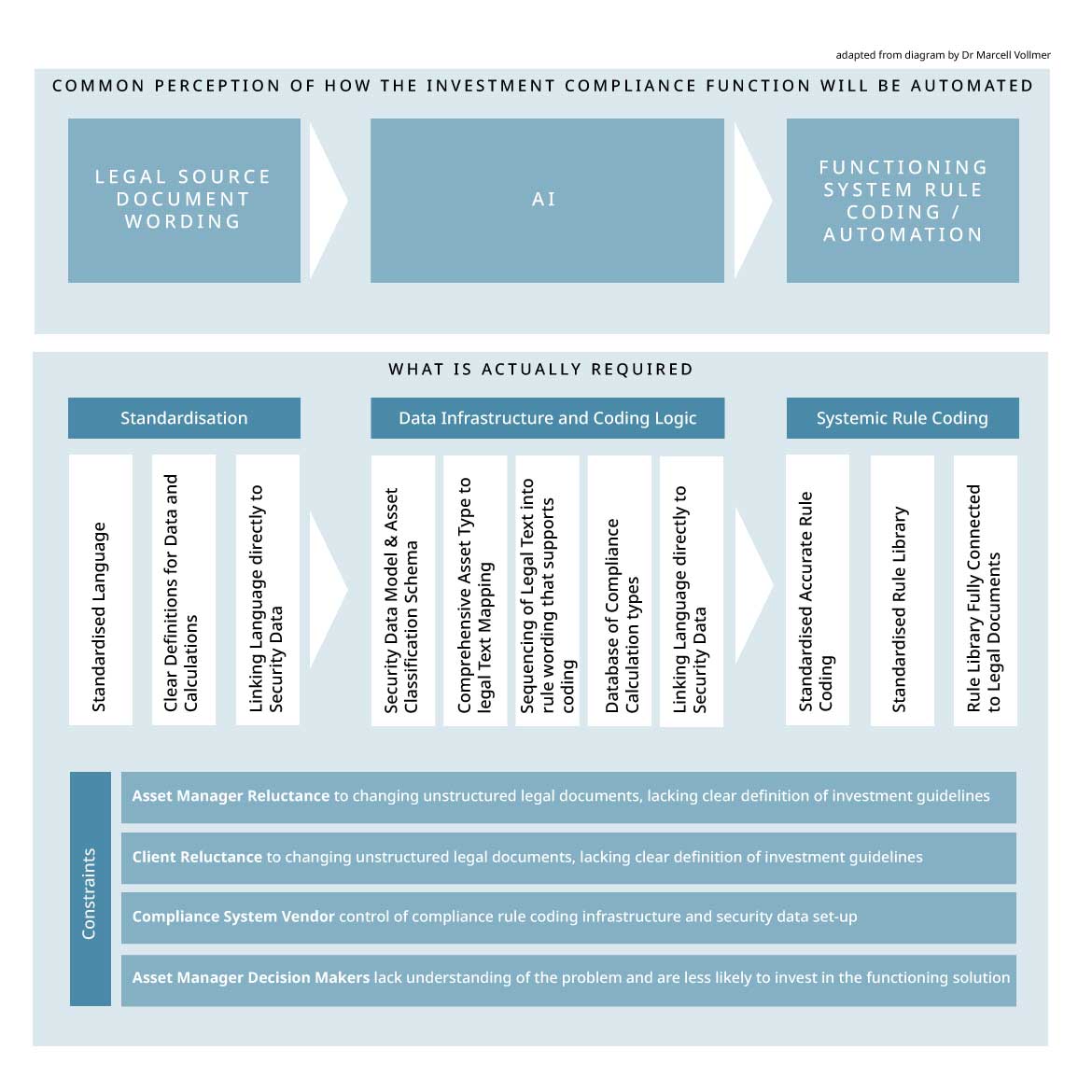

There are many that suggest the investment compliance function should be reformed and automated with AI document reading tools and AI based coding. Automated extraction of investment guidelines from IMAs will be the starting point for many asset managers, and large quantities of capital will be spent on developing those types of tool sat different asset managers and other entities. Whilst these efforts may turn out to be the source of automation in the longer run, it is difficult to see how it could be achieved without the underlying groundwork being carried out thoroughly.

Perhaps the question should be asked whether the automation solutions being developed should work around the industry wide problem of having ‘freehand’ written investment guidelines which lack clear definitions, that are not connected to the monitoring system and security data? The missing link.

Perhaps the path to full automation could be achieved faster if the groundwork for standardising the legal documents, linking them to the source system data model and the standardisation of coding logic were to be carried out. Aside from the time it takes to get to full automation, the output quality of any solution that addresses the fundamental issues of document an coding standardisation will be greater.