First-hand practitioner knowledge of direct and indirect investment across the Private Equity, Venture Capital, Private Credit, Real Estate, and Infrastructure asset classes

Top-Tier Solutions for Alternative Investments

Our Alternative Investment Team combines years of industry leading Project Management expertise with in-depth knowledge of the industry, technological solutions and services.

- Change leadership, delivering multi-platform solutions to meet complex business requirements for Private Equity, Venture Capital, Private Credit, Real Estate, and Infrastructure investors.

- Delivery of the eFront and Aladdin Whole Portfolio Solution for Private Credit to a hybrid private and public market asset owner.

- Process design and solution delivery for front to back-office functions including deal sourcing, trade execution, compliance, accounting and reporting.

- Extensive knowledge in working with alternative investment data sets for integration and reporting purposes.

- Rollout of new fund structures and products including tax efficient feeder funds, evergreen funds and other tax efficient structures.

- The team has developed its knowledge of industry and business functions by working directly for GPs, LPs as well as Investment Managers alike, across business-as-usual an change roles.

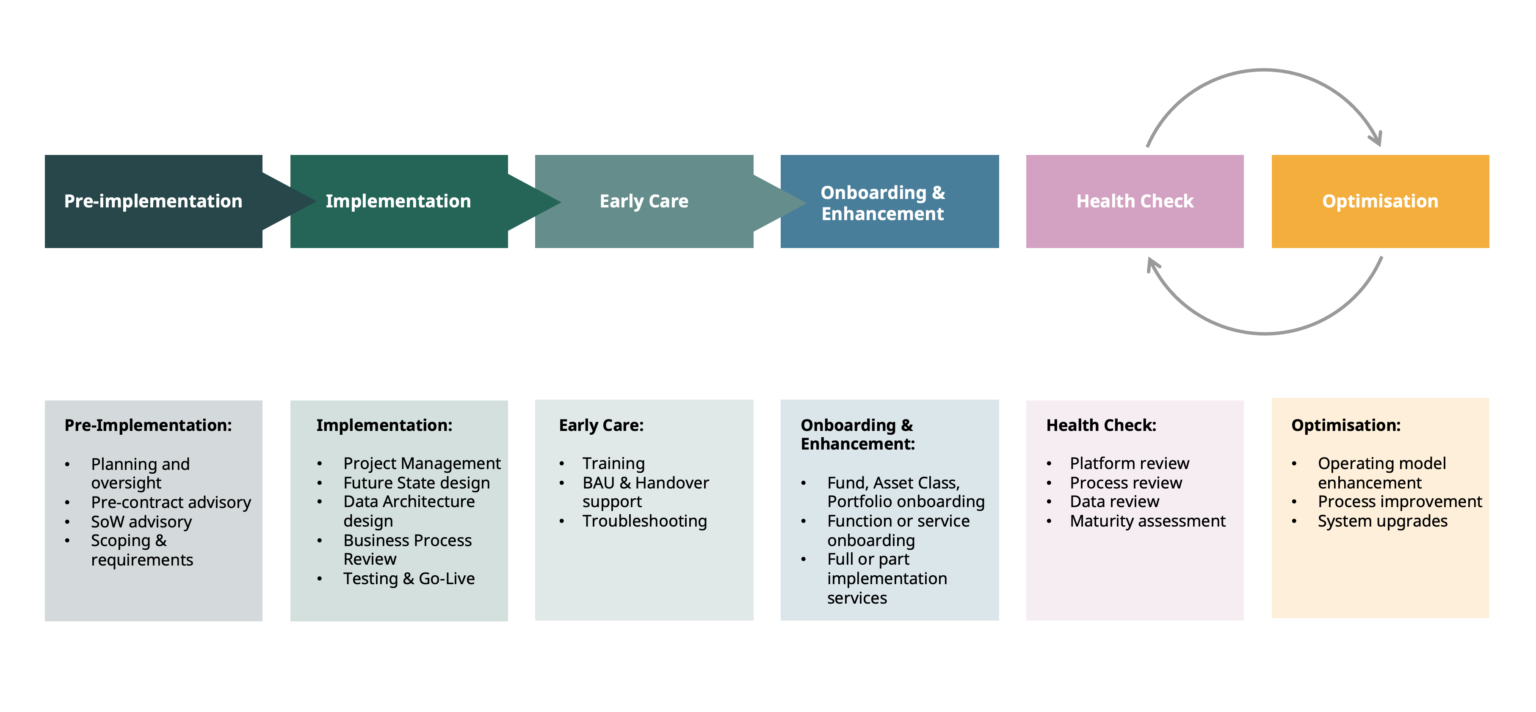

Strata Offers Services along the full Project Cycle

Implementations

Why do you need Implementation Support?

- A vendor will provide a project team to manage and delivery solutions from the vendor’s perspective.

- To achieve success, a client should establish an internal project team including a clear governance structure, as well as defined roles and responsibilities with representation covering project, eFront and business expertise.

- Investing in the right expertise today will ensure the risk of mistakes of increased costs are mitigated.

What Services are provided for Implementations?

- Programme management tailored to a client’s needs, including programme leadership, project management and PMO services.

- Support including pre and post project activities.

- Pre-contract and Statement of Work advisory services

- Requirements documentation and scoping across the full suite of eFront functions.

- Future State design through leveraging best practice and standard approaches.

- Data Architecture design to integrate eFront seamlessly into a wider technology stack.

- Business Process Review support and advisory services.

- End-to-End support including data migration, testing and training.

Public and Private Market Consolidation / Whole portfolio solution

What is the Public & Private Market Consolidation / Whole Portfolio Solution?

- Blackrock’s strategic approach to help investors manage operational processes to help investors manage operational processes across the whole portfolio covering public and private instruments.

- Streamlined and standardised processes to help investors achieve operational scale and consistency.

- Enhancements across portfolio management, compliance, risk and reporting.

- Additional options exist including market offerings and combinations of data consolidation and reporting methods.

What Services are provided for a Public & Private Market Consolidation / Whole Portfolio Solution project?

- We help clients to understand and evaluate potential solutions, including Aladdin’s Whole Portfolio Solution, as well as other market offerings.

- eFront setup review to determine. readiness to integrate with the Whole Portfolio Solution or another solution such as data lake with reporting tools.

- Scaleable operating model design to maximise operational gains from an integrated eFront and Aladdin (or other) solution.

- Optimised Data Architecture design to ensure a streamlined, scalable and accessible dataset.

- Project Management and Implementation services to deliver a Whole Portfolio Solution.

Onboarding & Enhancement

Onboarding & Enhancement

- Launching or investing in new funds, products or asset classes.

- compliance and Regulatory requirements.

- Growth through acquisition

- Opportunities to streamline business functions.

- In-housing business functions

What Services are provided for Onboarding & Enhancement

- Scoping and planning including;

- Requirements documentation,

- Operating Model Review,

- Solution options and recommendations,

- Resourcing and Budgeting.

- Best Practice approach to new business process design, including aligning new functions into existing processes.

- End-to-End support including data migration, testing and training.

- Upgrade guidance and support, including strategy and testing.

- Project governance and management support tailored to the needs of each client and activity.

Operational Alpha

Why you could need the Operational Alpha

- Is your operating model still fit for purpose?

- Do expensive solutions contiue to meet business requirements?

- Are. you maximising the potential of your technology stack?

- Has process design kept pace with business growth and change?

- Has process and system knowledge been diluted over time?

- Is your setup ready for new functionality or connectivity such as the Whole Portfolio Solution?

What Services are provided with a Health Check/Operational Alpha

- A Health check is tailored to the specific needs of a client and can cover;

- Targeted function review,

- Operating model review,

- Full or part platform review, and

- Technology stack review.

- An eFront Invest Health Check includes;

- Review client utilisation of the eFront modules and functions that are in place.

- Review eFront services and modules that are available but not in use and that can enahnce a client’s setup.

- Ensure optimal setup and integrity of a client’s dataset, including reporting and interfaces.

- Review user experience and pain points

- Maturity assessment to review how a client’s setup adheres to standard and ensure future-proven.

Advisory

Advisory Services

- Do you have a first-class transformation programme in place?

- Are you prepared for changes to the industry?

- Does your operational strategy meet current and future needs?

What Advisory Services are Provided?

- Strategy & Future State Design;

- Create an operational strategy to support business growth and meet a changing regulatory landscape.

- Evaluation of current state, design of future state.

- Outsourcing of Back and Middle Office functions.

- Technology Stack Review;

- Current system and data structure and best practice setup.

- Programme Creation and Management;

- Tailored to business needs, from designing a governance framework, through to implementing and managing a programme of change.

- Vendor Selection

- Business requirements and Scope.

- Market Offerings, Request for Proposals and Evaluation of Vendors.

- Readiness Assessment

Meet Our Team

Team Leadership

Nick Rockhold

Head of Practice

Tayfun Atailer

Senior Manager

Our Alternative Investment team combines yeas of industry leading Project Management expertise with in-depth knowledge of industry, business functions and solutions.

Case Study linked below

- Change leadership, delivering multi-platform solutions to met complex business requirements (eFront, Yardi, MS Dynamics, etc) for Private Equity, Venture Capital, Private Credit, Real Estate, and Infrastructure investors.

- Delivery of the eFront and Aladdin Whole Portfolio Solution for Private Credit to a hybrid private and public market asset owner.

- Process design and solution delivery for front to back-office functions including deal sourcing, trade execution, compliance, accounting and reporting.

- Successes in delivering enhancements and process design to meet changing regulatory requirements such as AIFMD, MiFID, II, ESG and other tax reporting.

- Extensive knowledge in working with alternative investment data sets for integration and reporting purposes.

- Rollout of new fund structures and products including tax efficient feeder funds evergreen funds and other tax efficient structures.

- The team has developed its knowledge of industry and business functions by working directly for GPs, LPs as well as Investment Managers a like, across business-as-usual and change roles.

Schedule a Consultation

Solutions to enable your business

Aladdin

- Enterprise / Risk Implementations

- M&A integration

- Accounting & Performance

- Op Model design + Optimisation

- Risk, Data & Interfaces

- Aladdin Data Cloud

- Aladdin Climate

- Aladdin Wealth

- Operational Alpha

eFront & Alternative Investment Practice

Driving actionable insights for your business and your clients. Generating competitive advantage through our expertise in Data, Technology and Finance.

- Advisory

- Implementation

- Onboarding & Enhancement

- Health Check

- Public & Private Market Consolidation / Whole Portfolio Solution

Data & Analytics

Bringing to market innovative, value add products and services.

Custom Insight Generation

Data integration, Modelling & Accelerators

POC and prototyping

- Bespoke tooling

“Strata have integrated seamlessly into many areas of Newton’s Aladdin implementation project, providing deep subject matter expertise on the system and valuable experience of the challenges and pitfalls learned through their prior implementations.”

“The Strata team are game changers when it comes to data and analytics and have consistently delivered complex and ground-breaking solutions for M&G in true partnership style. From data modelling through to data surfacing and visualisation, they have collaborated and added real value to our front office stakeholders, in turn moving the dial on how we model and report on ESG. Strata's formula of combining deep investments knowledge, internal and vendor data expertise and technical capabilities delivers high impact results, and I would highly recommend them to anyone looking to take their use of data to the next level.”

"Strata have extensive knowledge and expertise on both complex OTC products and the Aladdin system, which they have utilised to great effect. The impact of their strategic approach and dynamic team on the Swiss Re business means we are already seeing a significant return on investment.”

"Strata supported Aegon AM's BlackRock Aladdin transformation journey. Strata helped us to design an optimal operating model and followed through with execution, testing and go-live activities. Their proficiency in grasping the macro perspective, but also being able to drive execution at a micro level with a diverse set of stakeholders was evident and helped to ensure best-practice utilisation of the Aladdin platform.”